Budget 2026: Drive Smarter, Cleaner BIK Outcomes

Irish employers providing company cars and vans face another year of Benefit-in-Kind (BIK) changes. The Department of Finance’s Tax Strategy Group (TSG) and Budget 2026 Tax Policy Changes papers confirm a continued policy shift toward rewarding cleaner vehicles and aligning BIK with emissions and usage.

For Payroll, HR and Fleet Managers, the message is clear: start modelling the 2026 tables now to protect payroll accuracy, support sustainability goals and keep staff communication clear.

What’s Changing in 2026

New “A1” Zero-Emission Band: 6 – 15 % depending on annual business kilometres; > 48,001 km = 6%.

Mileage thresholds revised: the top discount applies to very high business mileage (> 48,000 km).

€10,000 OMV reduction retained for all Category A–D vehicles (including EVs) through 2026 – 2028 (§ 5.2.2 Budget 2026).

Category E vehicles (high-emission) do not qualify for this reduction.

Finance Bill 2025 will confirm details, but the direction of travel is already clear.

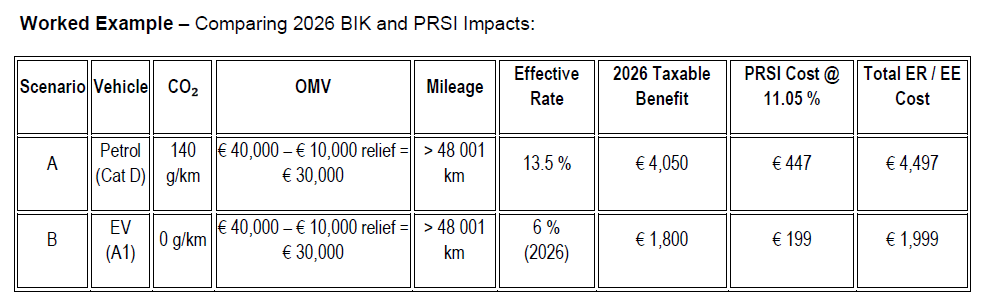

The above shows an annual saving of €2,250 for an employee plus €248 in employer PRSI - a combined € 2,500+ advantage per car per year in 2026. That differential narrows modestly as the OMV relief tapers resulting in a €300 increase in taxable benefit to €2,100 in 2027 and €450 increase to €2,250 in 2028.

Key insight: Mileage, emissions and the €10,000 OMV reduction act together to deliver meaningful savings for both employee and employer - while meeting ESG and CSRD obligations.

The EV Opportunity

The Irish Times (Oct 2025) today reports that electric company cars are now competitive on total cost of ownership thanks to lower energy and servicing costs. Employers can act now by:

Switching higher-mileage grey-fleet users into company-provided EVs to cut CO₂e, ensure insurance compliance and strengthen duty-of-care oversight.

Using the extended VRT relief (to end-2026) to offset purchase costs.

Applying home/workplace charging supports and capital allowances for energy-efficient plant.

Positioning greener vehicles as part of an employee-value proposition, improving attraction and retention in a tight labour market.

According to PwC’s Revenue Audit Support, accurate BIK computation and evidence of proactive payroll reviews are increasingly expected during audits - making readiness checks essential.

Strategic Steps for Employers

Plan – Model – Monitor – Engage

Plan: Map company-car allocations and high-mileage grey-fleet users.

Model: Compare 2026-2028 BIK and PRSI outcomes using A1 rates, mileage thresholds and the €10, 000 OMV reduction.

Monitor: Capture verified business-kilometre data and emissions performance through tools like DriverFocus ALLY.

Engage: Communicate changes early so employees understand both environmental and financial benefits.

Call to Action

With less than a quarter to go before the new tax year, now is the ideal time to benchmark your fleet exposure and identify cost-saving EV opportunities.

Book a DriverFocus “BIK Readiness Check” to keep your mileage reporting and payroll fully compliant. For deeper audit alignment, visit PwC Revenue Audit Support.

Read more practical guidance and safe-driving insights at driverfocus.ie/blog.

Reduce Admin and Boost Revenue Compliance

It’s Easy with Ireland’s #1 Mileage App

Sources:

TSG 25-10 Energy, Environmental & Vehicle Tax (2025): details on BIK bands and € 10,000 OMV relief for A–D vehicles.

Budget 2026 Tax Policy Changes Book (§ 5.2.2): confirms extension of OMV reduction and new A1 EV band.

TSG Potential 2026 BIK Table (29 Jul 2025): working rates used in calculations.

Irish Times, Oct 2025: “Business end of electric vehicles” – evidence of EV TCO advantage for Irish employers.